Whatever It Takes To Build Great Futures!

Make a Donation

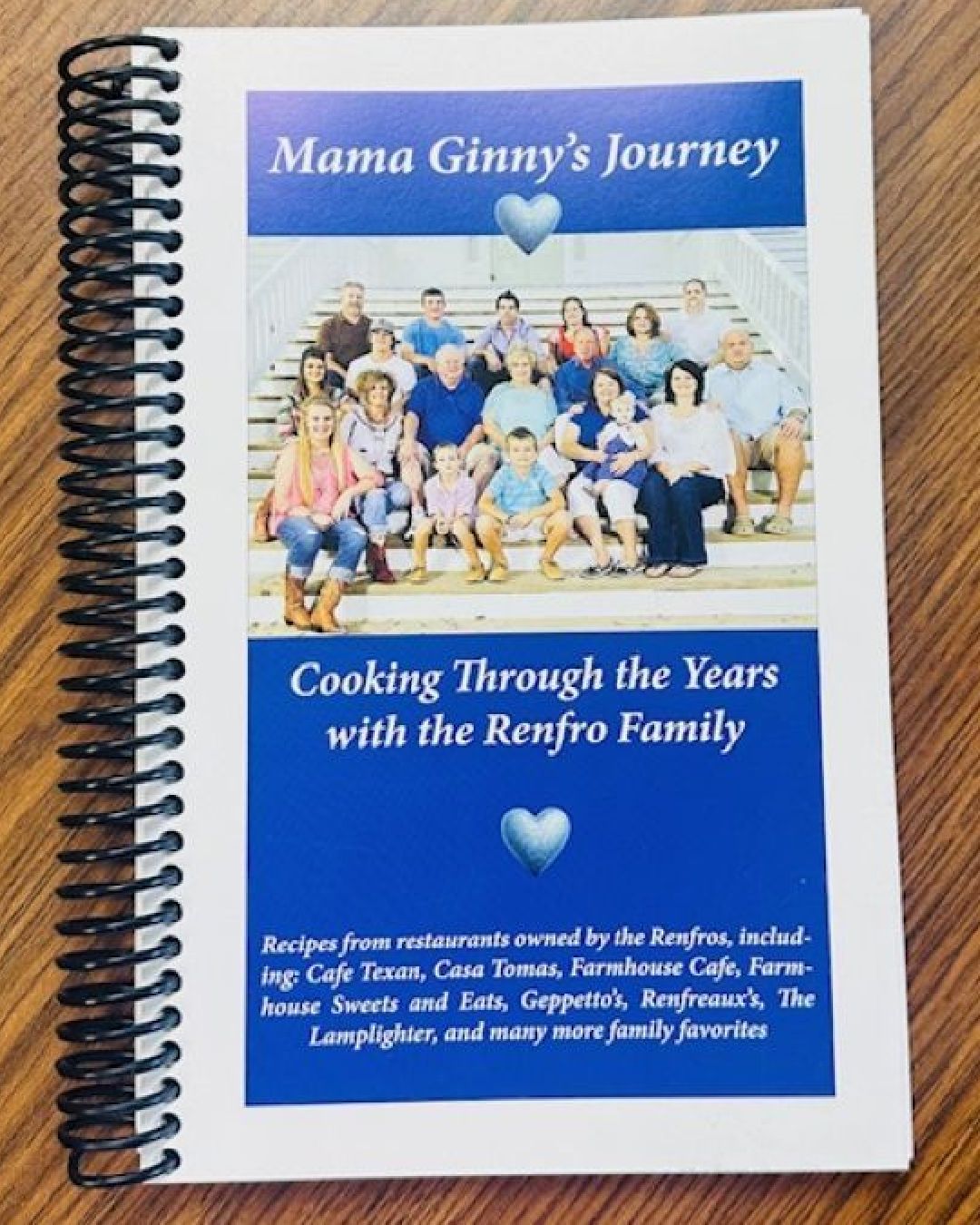

🍳 Mama Ginny’s Journey: Cooking Through the Years with the Renfro Family A Heartfelt Collection of Recipes, Memories, and Love

We are honored to share Mama Ginny’s Journey, a cookbook that preserves decades of culinary tradition, family stories, and treasured recipes from the Renfro family's beloved restaurants — including Café Texan, Casa Tomas, Farmhouse Café, Farmhouse Sweets and Eats, Geppetto’s, Renfreaux’s, The Lamplighter, and more.

This cookbook is more than just recipes — it’s a celebration of a life lived through food and service. Inside, you'll find rich flavors, family favorites, and the history of a family whose restaurants helped shape the taste of our community.

🕊️ Honoring Mama Ginny’s Legacy

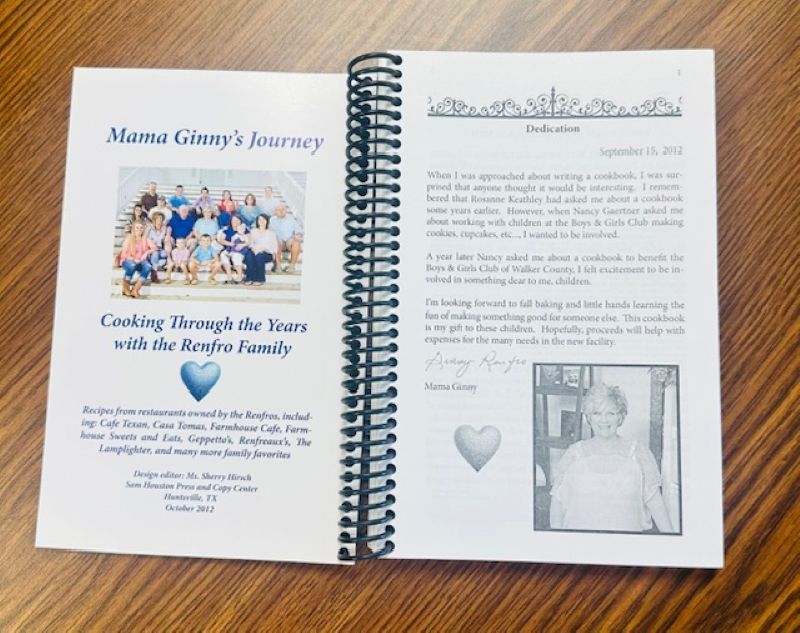

Mama Ginny passed away on December 29, 2024, but her warmth, spirit, and dedication live on through these pages. The Renfro family is proud to offer this cookbook for purchase in her memory, with all proceeds going to benefit the children of the Boys & Girls Club of Walker County — a cause close to her heart.

📖 Get Your Copy

Whether you’re a longtime fan of the Renfro restaurants or simply love the joy of southern cooking and community, this cookbook makes a perfect addition to your kitchen — or a thoughtful gift.

You must make your purchase while at Farmhouse Cafe & Bakery, 1004 14th St, Huntsville, TX .

Once purchased, show your receipt to the hostess to redeem for your book.

Your Donations Allow Us to Continue to Serve the Children of Walker County

to our operations:

- To make a contribution using your credit card or PayPal account, click on the icon to the right.

- Send your check to:

Boys & Girls Club of Walker County

P.O. Box 8600, Huntsville, Texas 77340

- To donate goods and services or to gift us through any tax-advantaged methods, please call us at 936-291-6054

to discuss how we can assist you to achieve your aims.